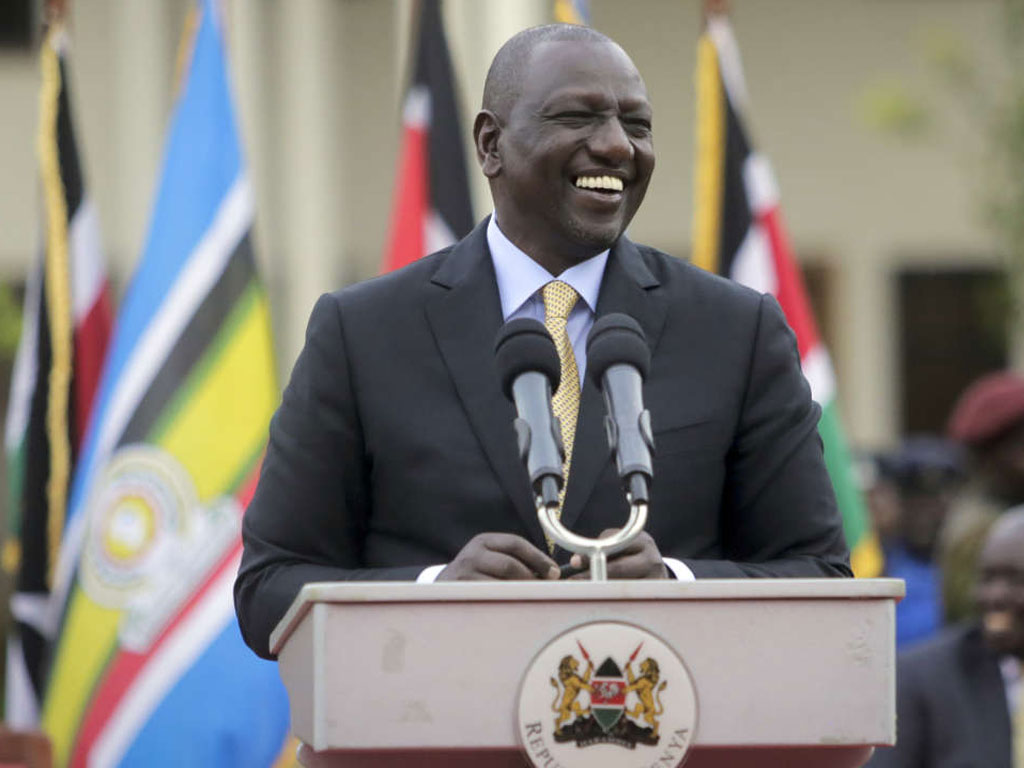

President William Ruto has presided over the taxpayer’s day in Mombasa where he asked the Kenya revenue authority to be easy on the low income earners and ensure full tax payment compliance to high income earners

Ruto has also announced that revenue collection across the country has significantly increased following the government’s decision to digitize State services.

President Ruto noted that the digitisation of 13,000 government services has led to a substantial surge in monthly revenues, with collections now totaling Ksh.9 billion up from Ksh.1.5 billion.

“I will repeat this, not only is it possible to be efficient and effective while being courteous and considerate, it is the only way to serve taxpayers and other members of the public. It is not necessary for effective revenue collection to be unpleasant and demeaning to members of the public,” he said.

In the event aimed at celebrating Kenyans who have defied all odds to ensure that they meet their statutory obligations

The head of state has also vowed that his administration will remain intolerant to corruption fostered through the Public Audit Amendment Bill 2023 that has already been approved by the cabinet.

“In line with this, today, the Cabinet approved Public Audit (Amendment) Bill, 2023, which will enhance the Auditor-General’s independence and transparency to ensure proper utilization of public resources through audits and also provide power for fraud investigations,” he said.

“It is important that as government, we communicate this commitment clearly, because the citizens and taxpayers deserve to know it as a matter of right. Our taxpayers are supporting national transformation by financing the provision of public services, strategic investments and our national revenue sovereignty.”

Also present at the event was Deputy President Rigathi who while defending President William Ruto foreign visit said the country’s tourism sector is booming.